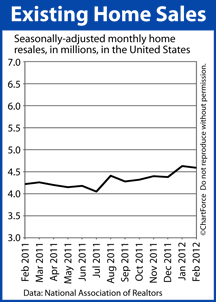

The market for home resales stays strong.

Despite sparse home inventory, the National Association of REALTORS® reports that 4.59 million existing homes were sold in February on a seasonally-adjusted, annualized basis. An “existing home” is a home that cannot be classified as new construction.

Last month’s sales data represents a 9 percent improvement from the year prior.

There are now just 2.43 million homes for sale nationwide — a 19% reduction versus a year ago. The complete home inventory would “sell out” in 6.4 months at the current sales pace.

Some analysts believe that a 6-month home supply indicates a housing market in balance.

The real estate trade group’s report contained other noteworthy statistics, too :

- 32 percent of home sales were made to first-time buyers

- 33 percent of home sales were made with cash (i.e. no mortgage)

- 34 percent of home sales were of foreclosed homes or homes in short sale

In addition, nearly one-third of all home sales “failed” last month, the result of homes not appraising at the purchase price; or, the buyer’s inability to secure mortgage financing; or, insurmountable home inspection issues.

Even accounting for last month’s high contract failure rate,though, the Existing Home Sales report still posted its second-highest reading since May 2010. For today’s home buyer, the data may be a “buy signal”.

As compared to last fall, home supplies are down and home sales are up. Basic economics tell us that home prices should start to rise shortly — if they haven’t already. After all, the Existing Home Sales data is 30 days old, reporting on February. It’s nearly April today.

The good news is that homes remain affordable. With conforming and FHA mortgage rates in the low-4 percent range, home affordability is at its highest in history. Home prices may rise this spring, but at least your mortgage payment should remain low.